Introduction

The global carbon market, encompassing compliance and voluntary segments, has been in flux for over a year. The compliance carbon market has seen substantial regulatory activity and expansion, while the voluntary market has faced setbacks in credibility, liquidity, and trust due to scrutiny over the quality and integrity of carbon credits.

The reintroduction of voluntary carbon credit trading in China, volatile price swings in compliance markets across Europe, North America, and Asia, and an increased focus on high-integrity carbon removals are shaping the future of this industry. This article provides a full-spectrum analysis of the current state of the global carbon market, including regional dynamics, key market trends, policy changes, pricing volatility, and expected developments for 2025 and beyond.

1. The Compliance Carbon Market: Expansions, Integration, and Policy Reforms

1.1 The Growth of Compliance Carbon Markets

Compliance carbon markets (also known as Emissions Trading Systems or ETS) are regulatory frameworks where governments set a cap on emissions and require industries to trade emission allowances. These markets have become the primary mechanisms for enforcing emissions reductions globally. In 2024 and 2025, compliance markets are expected to grow significantly due to government mandates and corporate net-zero commitments.

Key Compliance Markets in 2024:

- European Union Emissions Trading System (EU ETS): The world’s largest and most mature carbon market, covering over 11,000 installations in energy and industry.

- China’s National Carbon Market: It was established in 2021 for power utilities and will expand to steel, cement, and aluminium by the end of 2025.

- United Kingdom Emissions Trading System (UK ETS): It was established post-Brexit, and there are ongoing discussions to integrate it with the EU ETS.

- South Korea ETS (K-ETS): Asia’s most advanced compliance market, currently expanding its coverage and auction system.

- California Cap-and-Trade System: Is North America’s most developed carbon market, linked with Québec.

- New Zealand ETS (NZ ETS): This is one of the first carbon trading programs to include forestry offsets.

- Japan and Indonesia’s Emerging ETS: Both countries are developing market-based approaches to drive decarbonisation.

1.2 Expansion and Integration of Carbon Markets

There is a growing push to integrate and link carbon markets to create more liquidity and pricing stability.

- EU-UK ETS Integration: The UK and EU have considered linking their markets to create a broader, more liquid trading environment.

- China’s Carbon Market Expansion: The inclusion of more industries in China’s compliance market will significantly impact global carbon pricing.

- Japan and Indonesia’s Carbon Trading Initiatives: Indonesia is launching a forestry-based carbon market, and Japan has introduced pilot ETS programs.

These developments point to increased regulatory oversight and greater enforcement of carbon trading programs globally. The expansion and integration of carbon markets are crucial for creating efficient, liquid, and transparent trading systems that can effectively drive global decarbonisation efforts. Expanding these markets means broadening their scope to include additional sectors, industries, and participants, thereby increasing the coverage of greenhouse gas emissions under-regulated systems.

Conversely, integration involves linking different carbon markets across regions or countries to enhance liquidity, minimise price volatility, and promote consistency in carbon pricing. Such integration fosters cross-border collaboration and helps reduce mitigation costs by allowing entities to access a larger pool of carbon credits. These developments signify the move towards a more harmonised global approach to carbon trading, which is essential for meeting international climate goals. Furthermore, integrated markets can better withstand economic fluctuations and policy changes, ensuring more stable and predictable carbon prices and thereby encouraging long-term investments in low-carbon technologies and sustainable practices.

2. The Voluntary Carbon Market (VCM): Trust Crisis and Resurgence

2.1 The Challenges Facing the Voluntary Carbon Market

The voluntary carbon market has suffered from a credibility crisis due to concerns over the integrity of carbon offset projects. Investigations into “phantom offsets”—credits issued for projects that did not achieve real emissions reductions—have dampened demand.

Challenges in the VCM:

- Lack of Standardisation: Different registries (e.g., Verra, Gold Standard, Climate Action Reserve) have different methodologies, making quality assurance difficult.

- Oversupply of Low-Quality Credits: A glut of low-quality REDD+ (forestry-based) credits has reduced buyer confidence.

- Corporate Greenwashing Concerns: Major corporations like Nestlé and Gucci have resisted purchasing voluntary carbon credits due to reputational risks.

- Regulatory Uncertainty: Governments are stepping in to regulate voluntary markets, raising uncertainty about how they will operate alongside compliance markets.

2.2 China’s Voluntary Market Revival

The relaunch of China’s China Certified Emission Reduction (CCER) program in early 2024 has generated significant attention. Initially suspended in 2017 due to quality concerns, the program was reintroduced with stricter eligibility criteria.

The new CCER program focuses on:

- Deepwater offshore wind farms

- Solar thermal power

- Mangrove restoration and afforestation

- Methane emission recovery and efficient lighting projects

The return of CCERs resulted in wild price swings, with prices initially rising to 107.36 yuan ($14.82) per ton before falling to 72.81 yuan due to speculative trading and limited supply. China’s voluntary market is expected to mature with greater regulatory oversight, potentially influencing global voluntary credit trading.

2.3 The Future of the Voluntary Carbon Market

The VCM is shifting toward high-quality carbon removal credits and stricter verification mechanisms to regain credibility. Key trends include:

- Increased demand for direct air capture (DAC) and biochar-based removal credits

- Third-party verification and blockchain-based transparency mechanisms

- ISO 14068 and COP29’s new global carbon market framework to improve trust

Market analysts predict demand for high-integrity credits may resurgence by 2025 as companies align their net-zero targets with high-integrity credits. Additionally, the future of the voluntary carbon market will likely be shaped by stronger integration with compliance markets. Governments may begin recognising high-integrity voluntary credits as suitable for offsetting Scope 3 emissions within regulated systems. Furthermore, the introduction of new financial products, such as carbon-backed bonds and derivatives, will expand market participation and liquidity. Companies seeking to meet ambitious net-zero targets will drive greater demand for verified removal credits, encouraging project developers to innovate and ensure the highest standards of environmental integrity. This evolution will position the VCM as a credible, effective tool for global emissions reduction, especially when supported by digital technologies and rigorous regulatory frameworks.

3. Global Carbon Pricing Trends and Market Volatility

Carbon pricing has been highly volatile, driven by policy changes, economic conditions, and market speculation.

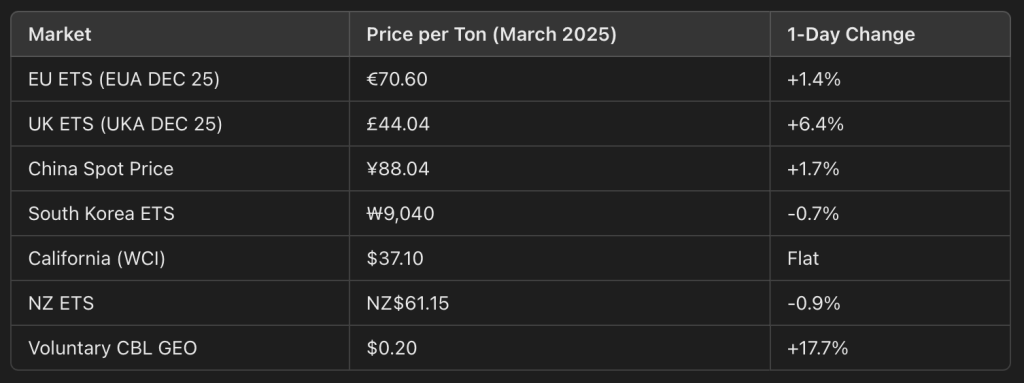

3.1 Global Carbon Price Comparison (March 2025)

3.2 Factors Influencing Price Volatility

- China’s CCER Restart: Uncertain demand and government intervention.

- EU ETS Reforms: The reforms include stricter regulations and increased auction prices.

- Supply-Demand Imbalance: This is set by seasonal trading trends and corporate offsetting strategies.

- Macroeconomic Pressures: Inflation and slowing economic growth have affected corporate demand for carbon credits.

4. 2025 and Beyond: What to Expect in the Global Carbon Market

Based on the latest developments, we can anticipate the following key trends for the coming year:

4.1 Growth and Maturation of Compliance Markets

- China’s ETS will expand to include heavy industries like cement and steel.

- The EU ETS will increase carbon prices through reduced allowance allocations.

- The UK may integrate with the EU ETS, creating a stronger trading bloc.

- The U.S. may implement a federal cap-and-trade system under new climate policies.

4.2 The Voluntary Carbon Market’s Shift to High-Quality Credits

- Carbon removals (e.g., direct air capture, biochar, enhanced weathering) will gain market share.

- ISO 14068 and COP29’s new rules will introduce stronger verification standards.

- Blockchain and AI-driven verification will reduce fraud and enhance market trust.

4.3 Integration Between Compliance and Voluntary Markets

- Companies may use voluntary credits for Scope 3 emissions compliance.

- New financial products, such as carbon-backed bonds and futures, will emerge.

- Governments may regulate voluntary credits more strictly, impacting future demand.

Conclusion

The global carbon market is at a critical turning point. Compliance markets are growing in size and regulation, while voluntary markets attempt to recover from a credibility crisis. China’s reintroduction of CCER trading and Europe’s tightening of ETS rules will significantly impact market trends. By 2025, we expect higher carbon prices, stricter regulations, and a shift toward high-quality removal credits. Companies and investors navigating this evolving landscape must adapt to these changes by prioritising transparency, regulatory compliance, and sustainable financing strategies.

As experts in carbon market dynamics, OceanBlocks profoundly understands the complexities within compliance and voluntary carbon systems. Our expertise allows us to guide companies in identifying credible investment opportunities within these markets while educating them about potential risks such as price volatility, regulatory uncertainty, and the integrity of specific carbon credit types. We assist clients in structuring their carbon portfolios to align with global best practices, ensuring that investments generate financial returns and deliver tangible environmental benefits. OceanBlocks’ consultative approach helps organisations navigate market entry, optimise their carbon credit strategies, and adhere to emerging regulatory frameworks—safeguarding their sustainability objectives and enhancing long-term market positioning.

Reference List

- Bloomberg. (2025). Trading of new carbon credits in China prompts wild price swings. [online] Available at: https://www.bloomberg.com/news/articles/2025-03-14/trading-of-new-carbon-credits-in-china-prompts-wild-price-swings [Accessed 24 Mar. 2025].

- China Briefing. (2025). Understanding the Relaunched China Certified Emission Reduction (CCER) Program: Potential Opportunities for Foreign Companies. [online] Available at: https://www.china-briefing.com/news/understanding-the-relaunched-china-certified-emission-reduction-ccer-program-potential-opportunities-for-foreign-companies [Accessed 24 Mar. 2025].

- Financial Times. (2025). Indonesia tests global carbon credits market linked to energy projects. [online] Available at: https://www.ft.com/content/68c82f0a-4588-4d8a-9171-d31954620688 [Accessed 24 Mar. 2025].

- MSCI. (2025). The frozen carbon credit market may thaw by 2025. [online] Available at: https://www.msci.com/www/blog-posts/frozen-carbon-credit-market-may [Accessed 24 Mar. 2025].

- Reuters. (2025). Comment: Why 2025 should see a carbon-neutral renaissance. [online] Available at: https://www.reuters.com/sustainability/sustainable-finance-reporting/comment-why-2025-should-see-carbon-neutral-renaissance-2025-01-20 [Accessed 24 Mar. 2025].

- Reuters. (2025). Indonesia plans to launch forestry-based carbon offset trade soon. [online] Available at: https://www.reuters.com/sustainability/indonesia-plans-launch-forestry-based-carbon-offset-trade-soon-antara-reports-2025-03-14 [Accessed 24 Mar. 2025].

- South Pole. (2025). Shaping the carbon market: What to expect in 2025. [online] Available at: https://www.southpole.com/blog/shaping-the-carbon-market-what-to-expect-in-2025 [Accessed 24 Mar. 2025].

- The Guardian. (2024). COP29’s new carbon market rules offer hope after scandal and deadlock. [online] Available at: https://www.theguardian.com/environment/2024/nov/24/cop29s-new-carbon-market-rules-offer-hope-after-scandal-and-deadlock [Accessed 24 Mar. 2025].

- Wall Street Journal. (2025). The year ahead in sustainable business. [online] Available at: https://www.wsj.com/articles/the-year-ahead-in-sustainable-business-21abf537 [Accessed 24 Mar. 2025].