Leading the Way.

The world is becoming more complex and is quickly evolving in response to the pressures facing interconnected supply chains, networks, and technology challenges. OceanBlocks is undertaking initiatives to define these problems with the greatest precision while searching for viable solutions upon which to take action. The solutions we explore can be translated back into companies with a strong desire to reduce emissions.

Investors want to place their wealth into businesses with growth potential that are planet conscious, and have a strategy to reduce emissions over time. Capital management and deployment are of particular significance in markets as over US$5 trillion in the world today is held by private entities. The barriers to capital access emphasise an essential role in capital qualification metrics for businesses seeking capital.

We believe that the owners of capital have a moral, ethical, and humanitarian role in mitigating the critical transformation required to stabilise global temperatures.

PRICING CARBON

Placing a Value on Carbon

Data accurate as of 27th March 2023. Unless explicitly stated, prices are in USD.

Source: https://carboncredits.com/carbon-prices-today/

THE TIME IS NOW

Capitalise on the Opportunity

As soon as possible, asset owners (including sovereign wealth funds, pension funds, superannuation, endowments, insurance companies and individuals) must immediately start reallocating their capital toward less emissions-intensive investments and green solutions.

The Facts

- Greenwashing is no longer acceptable. The ACCC is after companies that have ESG, sustainability and net-zero policies/strategies with little to no substance.

- ESV is more than investing in something that ‘looks’ or ‘feels’ green. Current systems and models for sustainability investment offer a little guarantee that the investment will (a) achieve an actual improvement in environmental outcomes or (b) actually deliver value (outside of marketing ‘green) to markets.

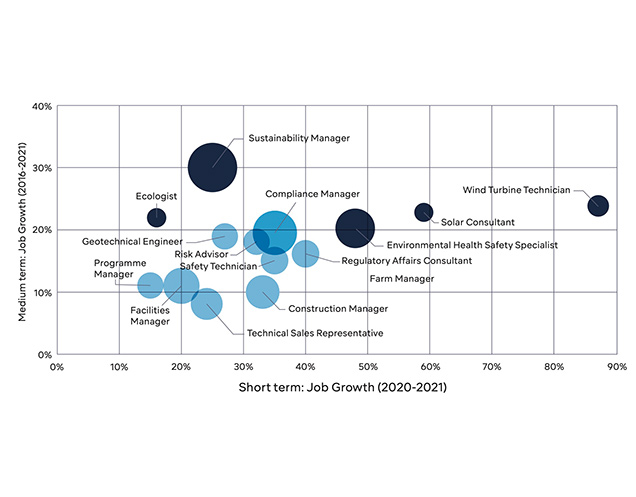

- Organisations need to consider the future of work and understand that ESG and ESV will also require a people strategy to help implement change.

Where to start?

Talk to OceanBlocks to find out how we can help adapt your strategies to align with ESG and ESV benefits.