The scientific evidence and warning signs from the natural environment signal that humanity must take firm action to address the impacts of global warming and climate change. How global economies intend to finance the structural transformation required to move away from fossil fuels towards a renewable future is far less clear. One area of increasing interest is that of regenerative economies and regenerative finance.

ReFi is an innovative financial system that promotes inclusivity, transparency, and accessibility. It provides opportunities to incorporate care for communities, living ecosystems, and the environment into our economic framework. Unlike conventional financial systems that often exploit resources, distribute profits unfairly, and disregard the value of living ecosystems, ReFi’s regenerative financial system benefits all of its living participants. Despite being in its early stages, ReFi has the power to revolutionise the way we use money and finance to support thriving life on our planet.

ReFi leverages blockchain technology to assess the value of natural assets in terms of their regeneration and preservation capabilities. Unlike conventional finance, ReFi does not solely rely on cash flows generated from asset utilisation for valuation. This approach prioritises sustainable environmental practices and offers a more holistic approach to asset valuation.

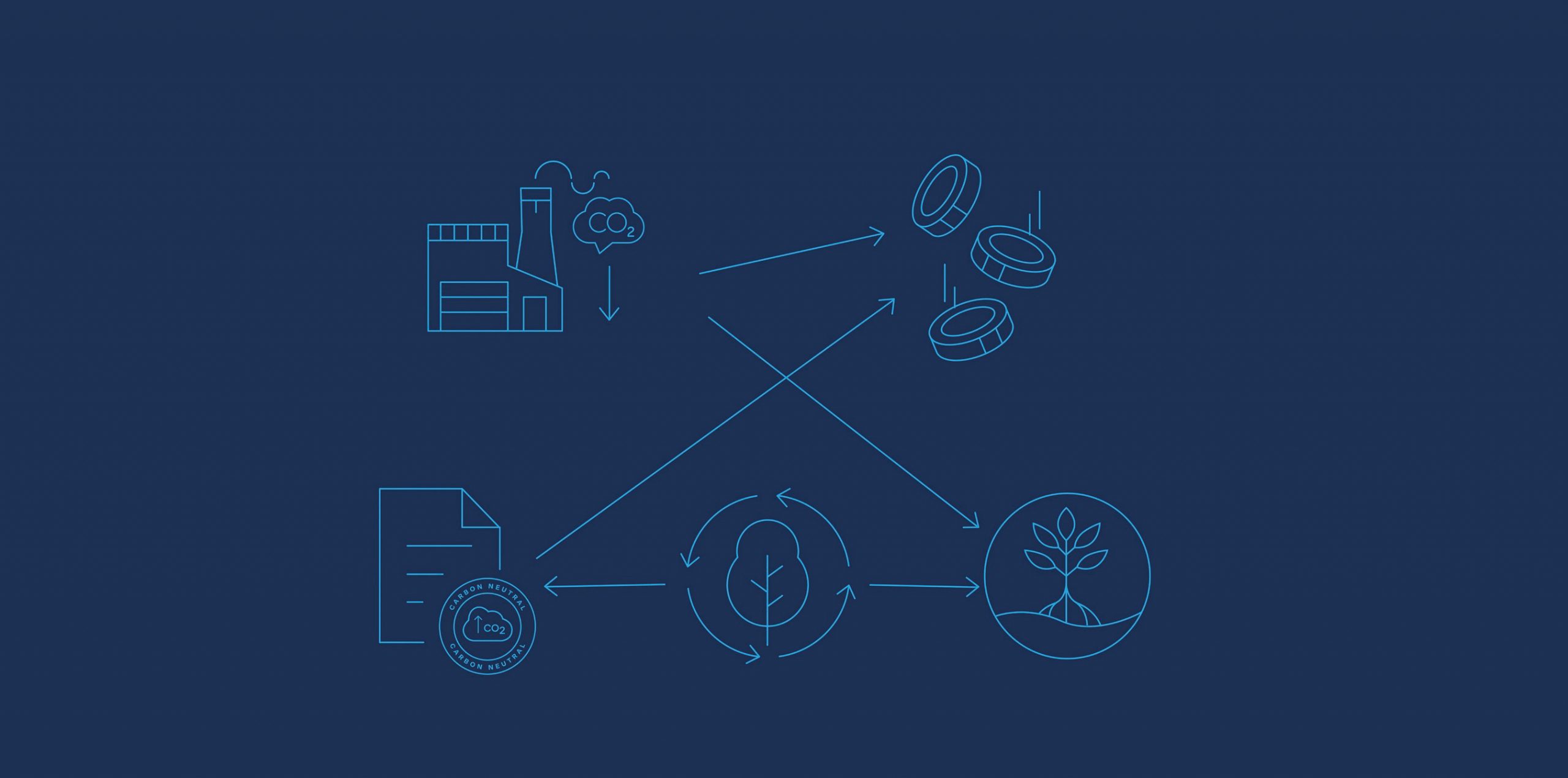

A pioneering economic model powered by blockchain technology involves:

• Evaluating natural assets by their capacity to absorb carbon or the cost of extracting a metric ton of carbon from the air

• Representing this value as a transferable financial instrument on the blockchain

• Facilitating financial liquidity for these assets.

The cost of carbon is not merely the expense of producing one ton of carbon emissions. Instead, it is the overall benefits derived from mitigating carbon emissions from the atmosphere. This concept allows for the evaluation of natural resources such as forests (green carbon) and oceans (blue carbon) as valuable carbon sinks. Numerous corporations, like Blackrock, Apple, Amazon, Microsoft, Unilever, and Google, are eager to participate in the carbon market to achieve carbon neutrality by 2030.

This article explores the advantages of ReFi, contrasts it with conventional financing methods, and highlights key players and advancements in the ReFi arena. Learn about the latest developments in the ReFi industry and discover how this approach to financing could benefit organisations.

The Importance of ReFi and Why it Matters

Blockchain: Revolutionizing Carbon Credits and Market Accessibility

In pursuing a regenerative economy, blockchain presents a game-changing solution. It simplifies the carbon market by enabling direct interaction between buyers and sellers, bypassing intermediaries that often breed uncertainty and inefficiency. With transparency as a core feature, blockchain eliminates the issue of double-counting, leading to more accurate information and better decision-making. By increasing inclusivity and accessibility, the platform opens opportunities for more participants to join the market, leading to a thriving and liquid market for carbon credits. Blockchains, thus, deliver enormous benefits to the carbon market, leading the way to a more sustainable future.

ReFi is distinct from traditional finance in several ways. ReFi aims to create shared value and promote sustainable progress, not just generate profits.

It accomplishes this by utilising financial resources to regenerate natural environments, support communities, and address systemic problems – all concerns mainstream financial institutions typically ignore. Unlike traditional financing methods, ReFi incorporates input from all stakeholders in its decision-making process, which empowers those who have invested the most and are most affected by outcomes, resulting in a more equitable distribution of economic control. In the next segment, we will delve into the significant benefits of ReFi.

Realise Positive Effects of ReFi

ReFi is a powerful tool that redirects investments towards businesses that have a positive, sustainable impact and helps them grow and succeed rapidly. ReFi addresses market failures that arise due to inefficient allocation of resources in private or free markets. Investors have primarily ignored carbon emissions, leading to detrimental environmental impacts that could cost the global economy up to $23T by 2050, amounting to a loss of 14% of its gross domestic product. ReFi can help businesses succeed by providing the necessary capital for thriving in a responsible, eco-friendly manner.

The world is facing a grave environmental crisis due to harmful carbon emissions and needs to take prompt action to avoid disaster. ReFi is an innovative solution that can efficiently allocate resources by considering both positive and negative impacts on society and the environment. Unlike traditional finance, ReFi incentivises enterprises to focus on beneficial social and environmental outcomes rather than solely on profits.

Though it may take time to see significant results, ReFi’s long-term framework in sustainable investments is essential to achieve a meaningful impact. A strategic approach is crucial to making a sustainable future a reality. ReFi investments can produce cost savings, enhance resource efficiency, deliver higher returns, and generate positive social and environmental benefits. Investing in ReFi is an investment in a better future for all.

OceanBlocks: The Blockchain-Based Carbon Trading Platform Saving the Oceans

As an environmental software fintech, OceanBlocks is driving the transformation to lower global carbon emissions. Utilising blockchain technology, we help enterprises address sustainability and ESG issues by increasing transparency and facilitating projects and innovations for carbon mitigation.

Our primary focus is on the blue carbon sector, as oceans provide the most significant carbon sequestration volumes while also locking away carbon in soil along coastal regions. OceanBlocks’ projects offer organisations the ability to purchase carbon credits as a way of demonstrating environmental stewardship or as a means to offset their excess carbon emissions.

Offsetting and carbon credits represent nations’ strategy to attain carbon neutrality and adhere to climate objectives. Carbon Offsets refer to anything that captures carbon and removes it from the atmosphere, while a carbon credit symbolises the corresponding offset. Companies aim to acquire as many offsets as possible, thus making carbon credits the lifeblood of the carbon market. Every person and business has a carbon footprint stemming from any activity that releases carbon into the atmosphere, including locally sourced food consumption, electricity use, gasoline consumption in vehicles, charging electric vehicles, and even taking showers. Although they can be traded on the carbon credit market, offsets are often viewed as compensation for eco-friendly individuals and organisations rather than digital assets.

Carbon Credits: An Overview. Each carbon credit is equivalent to one ton of carbon emitted into the atmosphere. Companies are given a carbon “cap,” which is the maximum amount of carbon emissions they can release into the atmosphere. If a company emits less than their cap, it can sell surplus credits to others, usually to companies that exceed their quota limits.

Anyone can use offsets, but only carbon credits are valid under cap-and-trade laws. There are different carbon reduction programs, each with varying levels of effectiveness. Though offsets and carbon credits have been criticised for their limited impact on climate change, 85% of carbon reduction projects have reportedly fallen short of their emission reduction goals. Consider these factors before purchasing carbon offsets or credits.

OceanBlocks came into existence to solve the problem that plagues 85% of the carbon credit market (the lack of factful carbon credits). We prove all parts of the carbon sequestration journey and convert those proven metrics into verifiable carbon tokens. The tokens are then sold to companies that have exceeded their legal quotas to help rebalance their carbon accounts.

The projects we undertake are at the foundation of our proven metrics and where we require consistent investment to enhance carbon sequestration volumes annually. ReFi investment pools are an obvious destination to help accelerate OceanBlocks initiatives. However, ReFi portals are also the future investment instruments for companies like ours to achieve carbon milestones along the net-zero journey.

Join us in our mission to address climate change responsibly, realise the commercial benefits of ESG, reduce risk, improve resilience, and stay abreast of growth opportunities.

The Global ReFi Movement: An Overview

The ReFi phenomenon is rapidly growing worldwide, with recent months seeing a surge in activity. ReFi enterprises are securing investments, forging collaborations, and releasing new products and financing programs to drive progress in the ReFi and Web 3 fields.

OceanBlocks is developing leading sustainable investment opportunities with global mangrove planting initiatives and seaweed and seagrass projects demonstrating blue carbon’s value. Our eco-friendly investing model allows ReFi investors to achieve steady returns while actively caring for the environment and communities. Additionally, we proudly offer carbon tokenisation services that empower clients to balance their carbon ledgers.

Despite the global economic slowdown, ReFi is expected to continue growing due to government commitments to climate pledges. Private enterprises are also getting on board as robust ESG record-keeping requirements for public enterprises spill over into the private markets. Investors and financiers now consider third-stage emissions paper trails as part of their risk analysis, making transparent methodology for emission reduction a must-have for companies seeking capital. With a sound ESG strategy, companies can avoid being denied capital access and falling behind on the path to carbon neutrality by 2050.

Conclusion

ReFi – is a sustainable crypto solution with immense potential to do good on multiple levels. With its focus on addressing climate change, ReFi is gaining popularity. Its financial returns make it a savvy choice for investing in sustainability initiatives. With ReFi, the responsibility of financing sustainable projects is shared across the private sector, alleviating the burden on governments. What sets ReFi apart from other cryptocurrencies is its tangible real-world applications. It is no wonder investors and philanthropists alike are turning to ReFi for a sustainable future, especially as crypto adoption becomes more prevalent.

OceanBlocks seeks your valuable input regarding the discussed points. We aim to establish dependable ReFi investor channels to enhance project sustainability and facilitate global emission reduction efforts. Your participation is crucial.